Option Vaults — Automated Options Strategies

Most of the yields within the DeFi ecosystem come from some sort of borrow/lend mechanism. Because of this, assets such as ETH or WBTC generally have relatively low yields — there is lots of supply, but very little borrow demand. Most borrowers prefer to borrow a stable asset like USDT or Dai.

Instead of lending, one of the most lucrative ways of earning yield on assets like ETH or WBTC is through option writing strategies. Option writing (selling options) can create enhanced yields (>30% APY) while maintaining exposure to the underlying asset, making it a great way to accumulate a specific asset. However, these strategies are not trivial to execute operationally — they require selection of option strikes and expiries, rolling over options, and constantly making decisions about yields vs risk-of-exercise.

Because of this, most people do not employ options strategies in their portfolio. The other alternative is to invest in a product or fund that executes this strategy for you. Unfortunately, many of the offerings that exist are only available to institutional investors and charge high fees for running such a strategy.

Ribbon is building on-chain Option Vaults that use smart contracts to automate various options strategies. Users can simply deposit their assets into a smart contract and will automatically start running a specific options strategy. This alleviates a majority of the gas problems by socializing the gas costs across all the vault depositors. Instead of doing 3–4 transactions per week per user, the vault will do 3–4 transactions per week for thousands of users at once. This makes the user experience of using these Option Vaults extremely straightforward and relatively cheap — deposit, wait for yields, and withdraw.

The first product that Ribbon is creating is called a Theta Vault, which is a yield-focused strategy on ETH and WBTC. The first Theta Vault will run a covered call strategy, which earns yield on a weekly basis through writing out of the money covered calls and collecting the premiums.

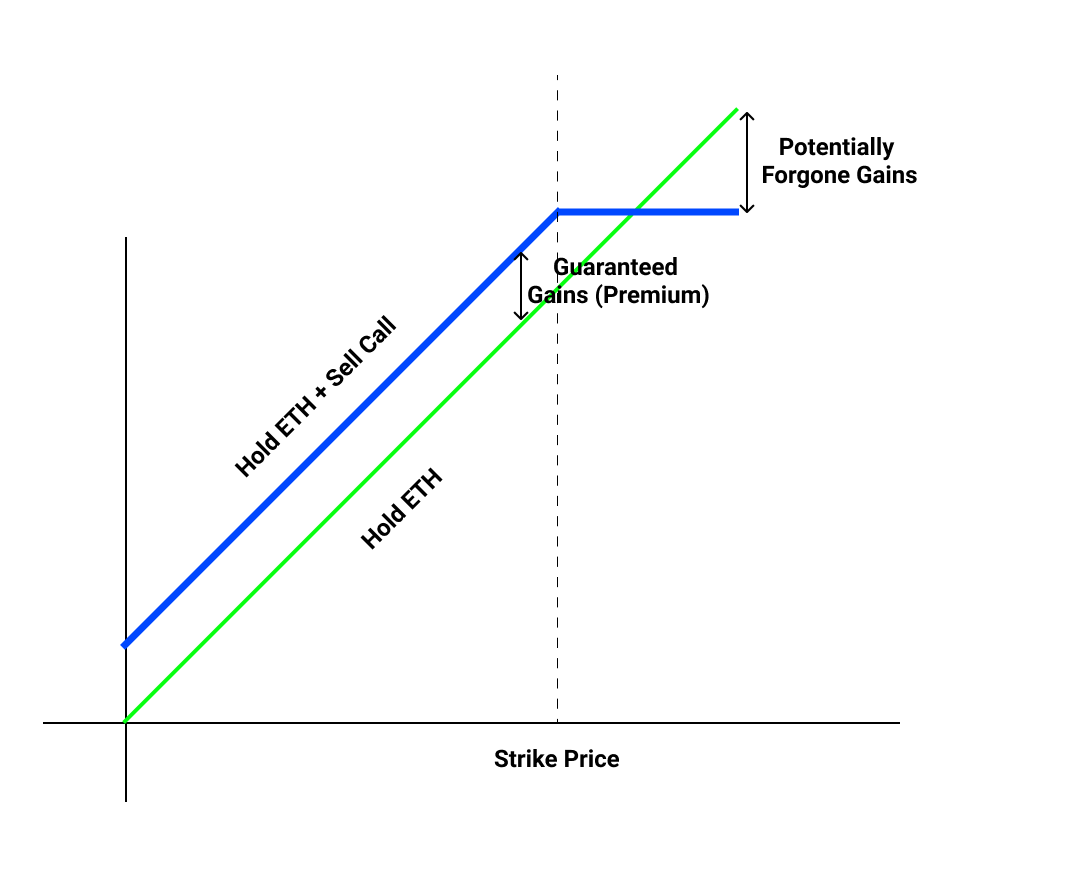

What is a covered call strategy?

The covered call strategy is a unique options strategy where you earn yield for selling potential upside of an asset. For example, if you are willing to give up potential upside of ETH going above $25k by the end of the year, you can get paid 2% in yield for selling a $25k call option. This is over 10x the yield you can earn by supplying ETH on Compound.

In the unlikely case that ETH goes to $30k, you would have given up $5k, but you are still tremendously up in USD terms — it is a win-win scenario for you because you only risk getting exercised when ETH absolutely moons.

Strike Selection and Expiry

To further reduce the risk of our options getting exercised, we can sell call options that expire sooner rather than later, because of how difficult it is to predict how ETH could perform over a longer time frame. Our initial vaults will sell weekly call options, meaning we can adjust our expectation of ETH’s price on a weekly basis. This also has the nice side effect of letting us compound our premiums more frequently.

Secondly, we need to select strike prices that are far enough from today’s spot price to reduce the risk of exercise. Our current methodology for strike selection and backtests show that we only get exercised less than 5% of the time from Jan 2020 to today, even throughout the entire run up of ETH from $80 to $2000. We will publish a follow-up blog post about our strike selection methodology in detail.

Technical Architecture

Theta Vaults in its present design relies on Opyn oTokens. oTokens are ERC20 token representations of an options contract, where each of them have a strike price and expiry. Owning oTokens is functionally equivalent to owning an options contract. This gives the oToken holder the right to redeem some amount of the underlying asset if the strike price is hit.

In order to run an options-writing strategy, the Vault needs to be able to mint and short oTokens. The Vault uses the users’ deposited funds to lock collateral into Opyn + mint oTokens, then sells them for a premium. The Vault’s collateral will be locked until the expiry of the oToken. This collateral is used to pay off oToken holders in the case that the options expire in the money.

To facilitate the week-by-week operations of Theta Vaults, there is a privileged role called the Manager. The Manager is responsible for:

Selecting the parameters of the oToken to mint i.e. strike price and expiry.

Signing oToken sales OTC on behalf of the Theta Vault

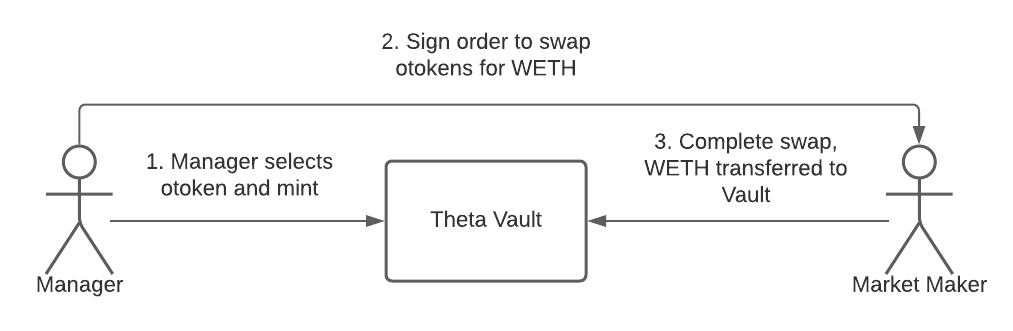

In collaboration with option market makers, below is a diagram of how an options sale is conducted:

Theta Vault mints oTokens

a) The manager selects an oToken to mint based on the parameters of strike price and expiry.

b) Vault uses deposited funds to lock collateral into Opyn protocol

c) Vault mints oToken and holds onto these oTokens

Initiating oToken trade

a) Manager and market makers decide on a price to sell the oTokens for (off-chain)

b) Manager signs an Airswap order that exchanges the oTokens for WETH on behalf of the Theta Vault

b) Manager sends the signed order to a market maker (off-chain)Completing oToken trade

a) Market maker counter-signs the order and posts the trade on the blockchain

b) The swap is completed, Vault receives premium in WETH whereas the market maker receives the oTokens

The net result of this process is that the Vaults should receive premiums in return for writing the oTokens. This will mean that the Vault’s balance will expand over time as premiums are collected and compounded.

Progressive Decentralization

As you can probably tell, there are a few pieces of this process that are more centralized:

Managers have sole discretion over strike selection

Managers and selected market makers decide on option prices off-chain (OTC).

We have whitelisted specific market makers who we are partnering with

Although we are starting with this, we plan to decentralize these functions over time once the vaults are more battle tested on mainnet. For example:

We plan to decentralize the function of the manager to a group of strategists that are voted on by the community, including better incentive mechanisms for encouraging good management of the vault

We plan to open up the option buying function to anyone in the community through an auction-like mechanism, and remove whitelists

Conclusion

We are aiming to launch an alpha version of the Theta Vault by the end of March. In the meantime, if you have feedback on the architecture of the system or have ideas for decentralization, we would love to discuss them in our Discord!