Volatility Strategies and Delta Hedging

As volatility traders, we aim to remain directionally neutral. If we do not want the directional risk, then we need to remove our risk to Delta and have more exposure to Theta, Gamma and Vega. It is important to understand what our view is and what risks we need to take to express that view. Essentially, delta-hedging allow us to put on more risk by removing the risk that we do not want to have exposure to.

Primer on volatility strategies and delta-hedging

Delta neutral strategies have found their place in the realm of DeFi. During the initial flourishing phase of DeFi, the cash-carry basis trade emerged as a prominent delta neutral strategy, delivering impressive annualized returns to traders. In fact, these returns reached double digits and soared as high as 40% on an annualized basis. Not too shabby considering that this strategy's investment returns are unaffected by the price fluctuations of the underlying asset.

However, over the years, such trades have become crowded as more smart money has poured into the space, diluting the alpha. Furthermore, specialized vaults have been developed to facilitate the execution of these strategies, offering users a convenient one-click solution.

What has been a rare bright spot recently for delta neutral strategies is volatility trading on crypto options. The emergence of the "short vol" strategy in the crypto market has gained popularity as a means of generating income over the past couple of years.

Referred to as "volatility traders," these individuals adopt a distinct perspective on volatility, aiming to maintain a directionally neutral stance while trading options.

Although most short volatility strategies begin as inherently delta neutral, the delta value usually deviates from zero over time due to the non-zero gamma exposure when the spot price moves away from the strike price at the strategy's inception.

As volatility traders, our objective is to focus our exposure primarily on vega, theta, and gamma, which are the Greeks specific to options and not present in the underlying asset. It is crucial to limit our delta exposure because excessive delta would imply taking a directional view rather than focusing solely on the volatility of the underlying asset.

Thus, we would need to delta-hedge our positions, to “flatten” our delta, such that after hedging, we are back at delta neutral, i.e., close to zero delta.

Delta-Hedging for Short Volatility Strategies

One of the most straightforward ways to delta hedge is to hedge using options. However, that defeats the purpose as it would also eliminate our non-delta greeks exposure such as vega if we are betting on IV to collapse. In this case, the purest form of delta-hedging would be to do so using spot or perpetuals since these instruments are also known as ‘delta-one’ products.

Here is a comprehensive example. At the time of writing, spot ETH is trading ~$1,813. Assume we have a view that IV will go lower over the coming month and that the underlying will trade sideways. To bet on that view, we can sell a $1.8K ATM ETH straddle. Let’s assume that we sold 10x straddles on the 30-JUN-23 expiry.

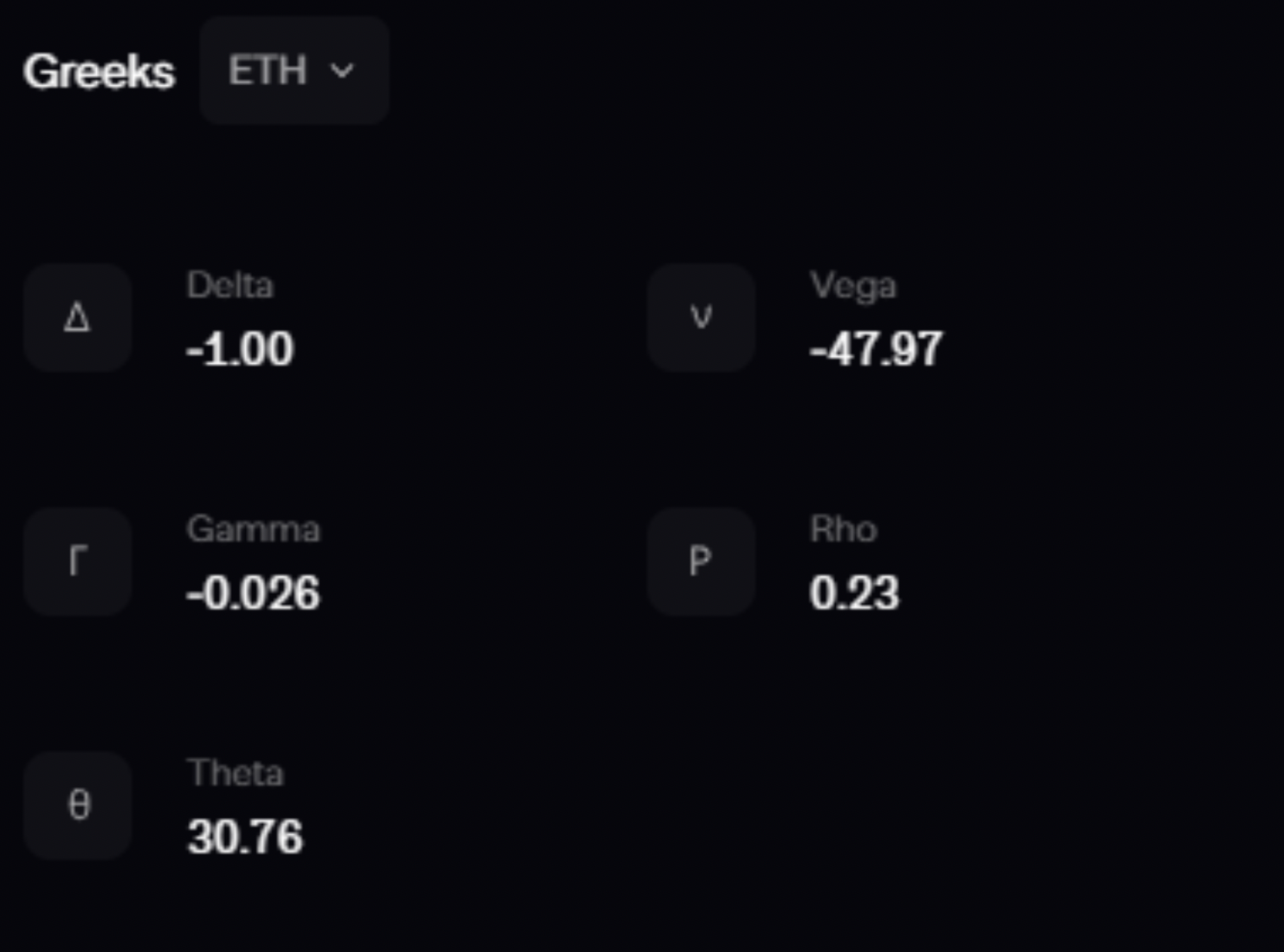

Because spot is not perfectly trading at the strike price, we can see that our straddle position is not perfectly delta neutral (figure 2). Looking under the “Portfolio” tab, we can scroll down and look at our “global” greeks, which represents the combined greeks across all of our options and perps position. In fact, we are currently short 1 delta on ETH.

Say we are comfortable with the -1 delta and decide not to delta-hedge. Instead, we will start delta-hedging as soon as our deltas breach above +3 or below -3.

Legs on Inception (day t):

10x Short ATM Call - short 5.5 deltas (-0.55 per contract)

10x Short ATM Put - long 4.5 deltas (0.45 per contract)

Net short 1 delta on ETH

Figure 1: Option chain on Aevo - $1.8K 30-JUN-23 ATM Straddle

Figure 2: Aevo ‘portfolio’ function - Greeks on trade inception

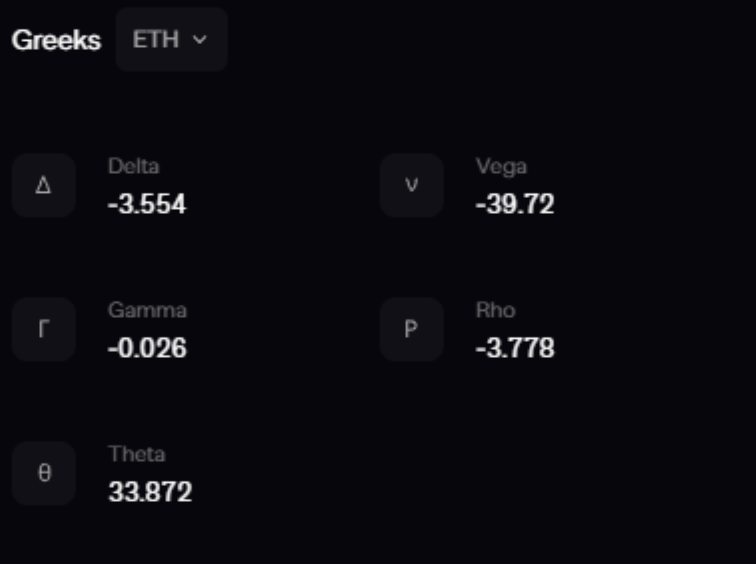

Let’s assume that 10 days later, ETH rallied by $100 and is now at $1.9K. Our call leg would have gained deltas while our put leg will have lost deltas. This means our position has gained more short deltas (figure 3). In other words, if ETH continue to rally, we will lose money, and if ETH goes down, we will gain money instead. We are no longer directionless and now we have greater exposure to delta.

Legs on Day t + 10:

10x Short ATM Call - short 6.777 deltas (-0.6777 per contract)

10x Short ATM Put - long 3.223 deltas (0.3223 per contract)

Net short -3.554 deltas on ETH as the call leg has gained deltas while the put leg has lost deltas

Figure 3: Aevo ‘portfolio’ function - Greeks on day t + 10

As mentioned, we do not want that as volatility traders. Initially, we placed the trade without a view on volatility, but now we have delta in our structure. We must either remove that risk, or include it into our thesis of ETH going down. However, most of the times, it is hard for us to have an edge in direction as volatility traders (at least for myself). Thus, we need to hedge our deltas.

In this case, we can simply hedge our short deltas by going long on ETH perps. We can do this conveniently on the Aevo platform.

Since our short straddle now has -3.554 deltas, we can delta-hedge it by going long 3.554 contracts of ETH perps to remove the directional risk. To do so, head over to the “trading” page, and select ETH perps, followed by going long 3.554 ETH perps (figure 4). After doing so, this brings us back to delta neutral. Now, all we are exposed to at this current time after delta-hedging is vega, theta, and gamma (figure 5).

Legs after Delta-Hedging:

Short straddle - short -3.554 deltas

Long ETH perps - long 3.554 deltas

Net zero delta (delta neutral)

Figure 4: Long 3.554 ETH perps on Aevo

Implementing a delta-hedging approach is crucial when managing a short volatility strategy. It involves carefully identifying and managing the specific risks you want to retain while eliminating those that you don't intend to take. In the upcoming part two, we will delve into gamma scalping and explore effective hedging strategies further.